Holistic Financial Planning Services in Greater Columbus, OH

Our purpose at Intelliplan Financial is simple and sincere — to provide comprehensive holistic financial planning services to middle class working people (not just the ultra-wealthy) in the greater Columbus area and beyond, so you can plan smarter and live better in retirement.

We do this by getting to know you, understanding where you want to be financially, and identifying any obstacles standing in your way. From there, we develop a comprehensive plan with tax efficient strategies that considers all aspects of your wealth and retirement income needs to help you live your retirement years as you envisioned.

What we offer

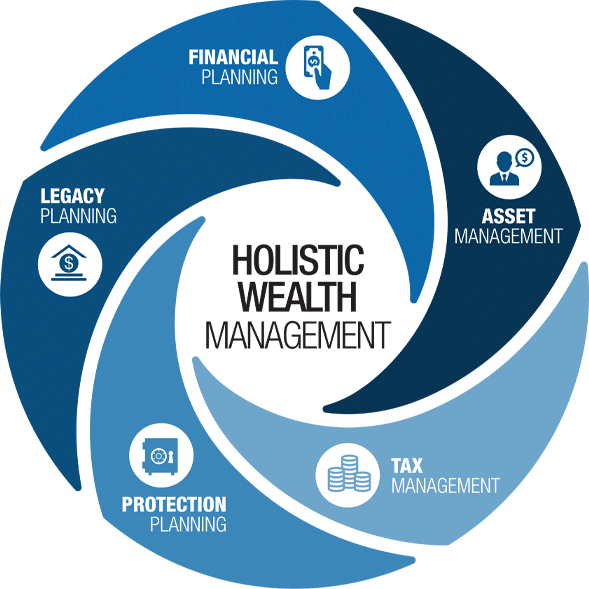

We strive to leave no stone unturned when it comes to planning for your financial future. Through our holistic approach to financial planning, we incorporate what we call the five pillars of wealth management to create a comprehensive strategy that’s personalized to your goals, needs, and assets.

Financial Planning

Whether you’re saving for retirement or a rainy day, strategic financial planning is key to working towards your goals and financial security. At Intelliplan, we use a proven holistic planning process known as The Bucket Plan® to consider the many facets of your financial situation and allocate them strategically into time horizons: now, soon, and later.

This approach is ideal for couples approaching retirement who want a coordinated strategy across all their financial decisions, not just investment management. We use it to help you grow and safeguard your assets for peace of mind through life’s — and the market’s — ups and downs.

Tax Management

It’s not what you make, it’s what you keep! Taxes will naturally take their piece of the pie, but their cut could be even greater if you’re not taking advantage of strategies to manage them proactively throughout your retirement years.

Our holistic plan includes tax-efficient retirement planning strategies from the advisor training, The Tax Management Journey®. We follow this framework to help maximize your retirement income and minimize your tax burden through withdrawal sequencing, Roth conversion analysis, and RMD planning.

Asset Management

While you could probably gather your assets yourself, effectively managing them as part of a complete retirement strategy is an entirely different ball game. We act as your guiding hand by offering tax-efficient investment strategies and custom portfolio design to help grow and protect your assets.

And our approach isn’t set it and forget it: we monitor, optimize, and adjust your investment plan over time as your needs and goals change.

Legacy Planning

You’ve worked hard to accumulate your wealth over the years to live comfortably and ensure those close to you can too. The last things you want are to needlessly lose assets to taxes, other wealth transfer costs, or to leave your loved ones to pick up the pieces when you’re gone.

We’ll work with you and alongside your attorneys to help protect your legacy and transfer wealth appropriately and efficiently, all according to your wishes. This estate planning coordination is especially important for business owners, blended families, and those with complex estate situations.

Protection Planning

Protection or “insurance” planning is often overlooked in financial planning because many people are overwhelmed by the many options or unclear of how it actually works. For instance, while life insurance will provide for the family in the event of an unexpected death, some policies offer safe and guaranteed cash accumulation for emergencies, as well as a tax-free retirement income.

We take our time to educate you on all your options, including the unique self-lending solutions we have to offer such as Bank On Yourself®, and recommend coverage or strategies that fit into your overall financial plan.

Unique Solutions at Intelliplan Financial

While life insurance can certainly provide death benefits and retirement income, it can also function as a ‘living’ life raft when you need it. We are one of a select number of financial advisory firms nationwide that offer Bank On Yourself®, the benefits of which helped our founder through tough times and inspired him to become an advisor.

Leveraging the Bank On Yourself® program as a retirement strategy, we can implement a personal, dividend-paying whole life insurance policy that can allow you to take advantage of powerful living benefits.

Frequently Asked Questions About Our Financial Planning Services

What is holistic financial planning?

Holistic financial planning is a coordinated approach that integrates all aspects of your financial life—retirement planning, tax management, investments, estate planning, and insurance—into one unified strategy. Rather than addressing each area separately, we create a comprehensive plan where every financial decision works together toward your retirement goals, ensuring nothing falls through the cracks and you have ongoing guidance and implementation support.

How do you plan for retirement?

Retirement planning starts with understanding your goals and desired lifestyle. We review your current income needs, evaluate all your accounts and assets, develop tax-aware withdrawal strategies, design an appropriate investment allocation, and provide annual updates as your life and goals evolve. Our process: Discover, Design, Deliver, and Dedicated helps ensure you have a clear roadmap and ongoing support throughout your retirement journey.

How do you plan for retirement in your 50s?

Planning for retirement in your 50s focuses on maximizing catch-up contributions to retirement accounts, evaluating Social Security timing strategies, considering early retirement scenarios, and building a tax-smart income plan. This decade is critical for stress-testing your retirement readiness, adjusting your savings rate if needed, and ensuring your investment allocation aligns with your approaching retirement timeline.

Is retirement income taxable?

Yes, but taxation depends on your income source. Traditional IRA and 401(k) distributions are fully taxable as ordinary income. Up to 85% of Social Security benefits may be taxable depending on your total income. Pensions are typically taxable. However, qualified withdrawals from Roth accounts and certain life insurance distributions can be tax-free. Strategic planning helps you manage tax brackets and Medicare-related income thresholds throughout retirement.

How can you reduce taxes in retirement?

Tax reduction in retirement involves careful withdrawal sequencing (deciding which accounts to tap first), strategic Roth conversions in lower-income years, proactive required minimum distribution (RMD) planning, and managing income to stay below key tax bracket and Medicare surcharge thresholds. Tax-efficient retirement planning as part of your overall income strategy helps you keep more of what you’ve saved.

What is tax-efficient retirement planning?

Tax-efficient retirement planning means designing your income streams and withdrawal timing to minimize your lifetime tax burden while supporting your legacy goals. This includes coordinating which accounts to draw from each year, timing Roth conversions, managing capital gains, and structuring distributions to preserve more after-tax income. The goal is keeping more of your money working for you throughout retirement.

Schedule a Consultation

If you’re a couple approaching retirement in the Columbus area looking for coordinated, tax-aware financial planning, not just investment management, we’d love to learn more about your situation.

Schedule a free 20-minute call with our team to start planning smarter and living better!