Embracing comprehensive wealth management

At Intelliplan Financial, we understand that navigating through financial decisions can be complex and overwhelming, especially when dealing with uncoordinated advice from various tax, legal, and financial professionals. Instead of forcing you to piece together each aspect of your finances yourself, we use a holistic planning approach to craft an all-encompassing, long-term wealth strategy for you.

What is Your Holistic Plan?

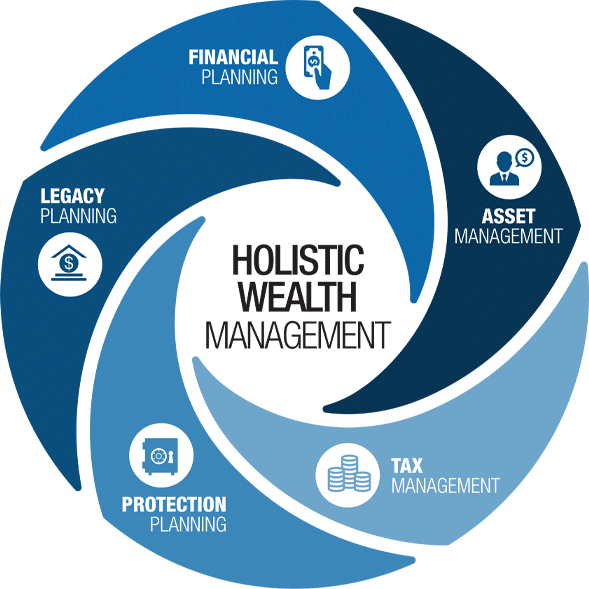

Financial advice often comes in pieces from various places, leaving you with a mix of products and services yet no clear plan of how they all work together. At Intelliplan, we craft detailed plans to avoid that issue by including all the essentials, or what we consider the five pillars of holistic wealth management: financial planning, asset management, tax management, protection or insurance planning, and legacy or estate planning.

By using The Bucket Plan® philosophy to create your comprehensive wealth management plan , we align your financial strategy with your goals for retirement, all within a framework that simplifies complex financial decisions.

The Value of a Holistic Advisor

Not every financial advisor considers every piece of your financial puzzle into one overall plan like we do. Our fiduciary advisors help optimize all your assets to help you reach your wealth goals, while striving to reduce inefficiencies like:

- Retirement income gaps

- Paying excessive taxes

- Risking everything from a catastrophic health issue

- Running out of money in retirement

See why our holistic advisory approach, once a privilege of the ultra-wealthy, now offers you a streamlined and client-centered experience, prioritizing your comprehensive needs.

How Do We Build Your Holistic Plan?

We use a systematic four-step approach to help us get to know you and build your holistic plan in your best interest.