Bank On Yourself® to Help Grow and Protect Your Finances

Gain financial independence through life insurance

We’re all susceptible to financial hardships or just unexpected expenses at some point in life and you can’t always rely on a bank loan or luck on Wall Street to get you through them. That’s why we use the Bank On Yourself strategy to help provide financial stability and access to your funds.

What is the Bank On Yourself Strategy?

A method to build wealth with life insurance

At Intelliplan Financial, we leverage the tried and trusted retirement plan alternative solution known as Bank On Yourself® when crafting your holistic financial plan.

Bank On Yourself offers a dependable retirement planning option by harnessing a lesser-known asset: dividend-paying whole life insurance. This approach leverages the asset’s remarkable resilience, demonstrating steady value growth across various market conditions for over 160 years.

How Does it Work?

The Bank On Yourself whole life insurance policies we design differ greatly from the traditional ones you may be familiar with. For one, no two policies are alike as every policy is carefully crafted and customized to suit the specific needs of each individual.

It requires a dividend-paying whole life insurance policy with supplementary features. A substantial portion of your premium is allocated towards two riders or options, accelerating the

growth of your funds within the policy beyond the pace of a traditional whole life policy.

Bank On Yourself policies must be written through a non-direct recognition mutual company that offers these unique riders to allow for increased cash value growth. With over a century of proven profitability and security, the companies we work with have been instrumental in shaping many pensions and retirement plans.

Key Benefits

In addition to the death benefit of a life insurance policy, you also receive tremendous benefits while still living.

Build Cash Value and Utilize Policy Loans

One of the greatest living benefits of a whole life insurance policy that uses this strategy is having access to your cash value through a policy loan to use as you wish: for emergencies, major purchases, business expenses, or to fund your retirement. You can become your own source of financing and your policy continues to grow without interruption.

Receive Several Tax Advantages

This type of permanent life insurance – if designed properly – offers many tax advantages, including tax deferred growth on cash value accumulation, tax-free access to your cash value, and income tax-free distribution of the death benefit to your heirs upon your passing, under current tax law. Check out our blog to learn more whole life insurance tax benefits.

Produce Tax-Free Retirement Income

You can use your whole life insurance cash value to supplement your retirement income without the requirements, penalties, or limitations that apply to 401(k) and IRA retirement accounts. Income taken from this type of policy can be tax-free and would not count towards your provisional income, meaning you will be able to keep more of your Social Security check.

Experience Predictable and Safe Growth

Bank On Yourself policies offer yearly growth at a contractually guaranteed and predictable rate, safeguarding your principal and gains from market downturns. This certainty provides peace of mind for retirement planning, allowing you to confidently determine the minimum guaranteed value of your policy each year.

Intelliplan’s Bank On Yourself® Expertise

Trust our Bank On Yourself Professionals

Our Bank On Yourself Professionals are among the fewer than 200* insurance agents nationwide trained and continuously educated to be Bank On Yourself Professionals.

Our firm believes in the power of this strategy not only because we know the ins and outs as certified Bank On Yourself Professionals, but also because we’ve personally experienced the living benefits ourselves!

Before founding Intelliplan Financial, Joe Overfield, was laid off unexpectedly and relied on this strategy to make it through hard times, inspiring him to become a Bank On Yourself Professional.

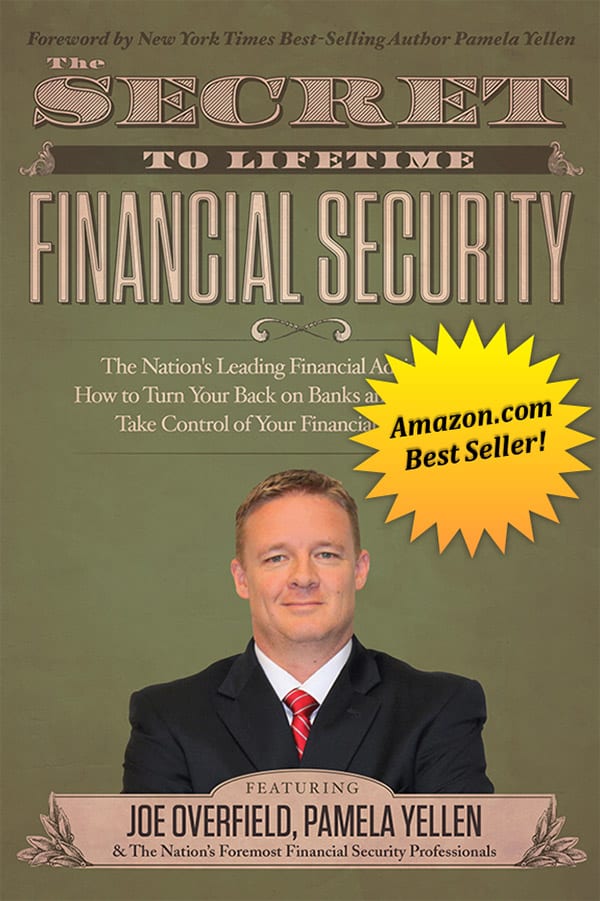

Joe has since earned recognition in the National Academy of Best-Selling Authors for his chapter, “Not All Life Insurance Policies Are Created Equal” in the best-selling book, The Secret to Lifetime Financial Security, by Bank On Yourself CEO, Pamela Yellen.

*As of May 2025

Bank On Yourself® is a registered trademark used with permission.