Living the life you envisioned in retirement can go from dream to reality with a well-coordinated holistic financial plan.

Life is complicated enough without financial worries or trying to plan for retirement on your own. At Intelliplan Financial, we’re here to be your guide and help you become crystal clear on your retirement goals, identify the obstacles that are getting in your way, and provide personalized solutions that will work to overcome those obstacles so that you can live your retirement years as you envisioned.

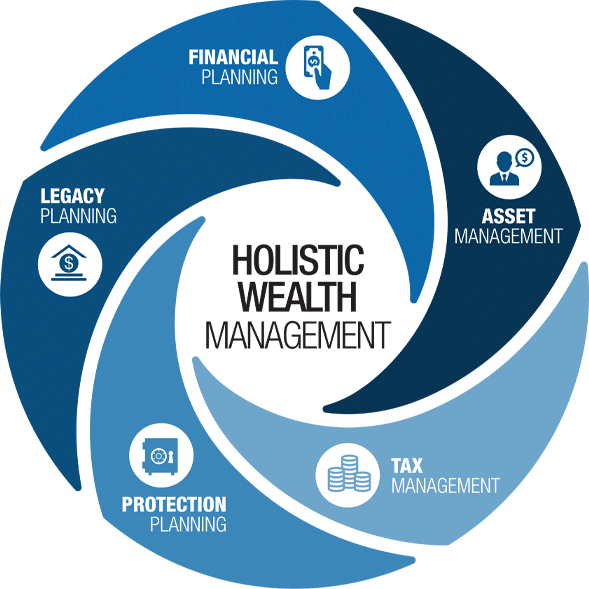

Our Holistic Wealth Management Services

All the key financial areas of your life in one easy, holistic plan.

Many financial advisors, and even you, can gather your assets. But not everyone can progress you towards your goals, whether that’s saving for retirement now or maximizing what you’ve accumulated tax-efficiently. In the Columbus, OH area and beyond, we’re proud to be the skilled fiduciaries you can trust. Our strong foundation of service is built on the five pillars of holistic wealth management: Financial Planning, Asset Management, Tax Management, Protection Planning, and Legacy Planning.

Who We Are

A team dedicated to helping you make smarter financial decisions

Nearly everyone deals with financial complexities at some point in life, including our founder, Joe Overfield. Through his personal and professional journey, Joe realized the power the right kind of financial planning can have. This sparked his desire to safeguard others’ futures through sincere guidance in their best interest.

Why Trust Intelliplan Financial for Comprehensive Financial Planning?

It’s easier to make confident decisions when you have all the facts and options in front of you. That’s what we’re all about at Intelliplan Financial. We coordinate all areas of your financial life through a holistic plan and educate you every step of the way.

Our Holistic Financial Planning Process

Financial planning doesn’t have to be complicated. Here’s how we keep it simple. We follow a four-step process that puts you first:

Step 1

Discover where you’re at, where you want to be, and what’s most important to you when it comes to your goals or desired lifestyle in retirement.

Step 2

Design a holistic plan with customized recommendations.

Step 3

Deliver your comprehensive plan, reviewing it step by step together before implementation.

Step 4

Provide dedicated and ongoing service and support.

Unique Solutions

What sets us apart is our commitment to offering innovative solutions beyond the norm of a typical financial advisor, ensuring we can truly cater to your needs as an individual, including:

Personalized Financial Advice in Your Best Interest

In addition to having a deep care for the well-being of our clients, we’re also fiduciaries. This CERTIFIED FINANCIAL FIDUCIARY® status means we’re held to a strict set of standards that require us to always act in your best interest — and we wouldn’t have it any other way.

Ongoing Education and Expertise

In our 17 years of serving people in their best interests, we’ve believed financial understanding should be accessible to all, and we excel in simplifying complex concepts for you. And to give you knowledge when you need it, we provide free educational content via webinars, blogs, and videos .