Are you worried about the impact of the Sequence of Returns Risk on your retirement plans?

If so, you have come to the right place. In this blog post, we’ll cover what exactly is sequence of returns risk and how it might affect your retirement savings.

Even if you don’t plan to retire within the next few years, you must understand this risk, as it could be relevant at any point during your future retirement years.

So take a deep breath and get ready for some valuable financial knowledge. Let’s dive into understanding just how much of an impact Sequence Of Returns Risk can have on your ability to enjoy life once all those working days are behind us!

Overview of Sequence of Returns Risk

As you begin withdrawing money from your retirement accounts, you become more vulnerable to market risk, and the year-by-year sequence of returns can have a huge impact on your savings. This is what we call sequence of returns risk.

Sequence of returns risk occurs when an investor experiences negative returns early on in retirement as they are withdrawing money from their account. This can dramatically impact an investor’s long-term financial security. These negative returns could cause you to run out of money sooner, which could impact your ability to maintain your standard of living throughout retirement.

This is because when markets are down, and you experience negative returns in your investment portfolio in the early years of retirement, withdrawals to support your expenses during that time come from a reduced portfolio value, leaving less money invested for future growth. So not only is your account decreased by the negative market return, it is also decreased by the money you withdrew as income. It’s a double-whammy!

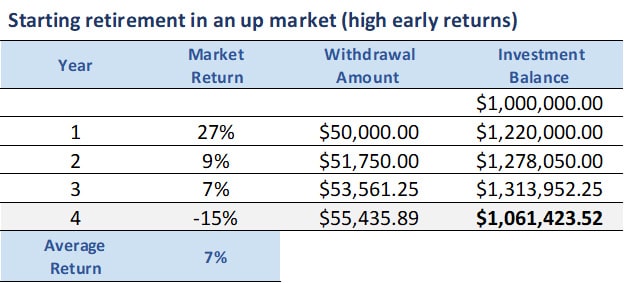

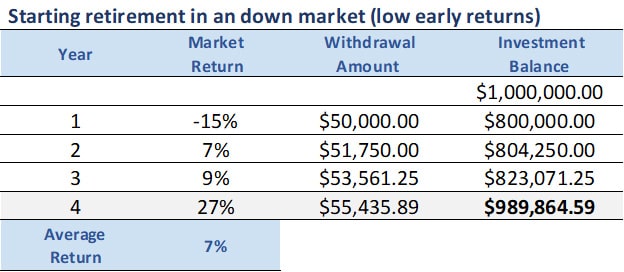

To demonstrate, let’s create a hypothetical example: Let’s say you retire with $1,000,000 in your retirement portfolio and plan to withdraw 5% per year ($50,000), assuming a 3.5% annual adjustment for inflation.

If you start withdrawing your retirement income in an up market over four years and receive returns of 27%, 9%, 7%, and -15% (average rate of return of 7%), your ending investment balance is $1,061,423.52.

Now let’s see what happens when we use the same returns but in a different sequence with the same average rate of return of 7%. This time we start withdrawing income in a down market over four years and receive returns of -15%, 7%, 9% and 27%. Your ending investment balance after four years is $989,864.59.

Compared to the up market example, that’s a $71,559 difference!

Think of the impact this could have on your retirement portfolio over a long period of time. You can see how this could cause damage to your retirement nest egg, and you could potentially run out of money quicker.

The good thing is there are steps you can take to help manage and reduce the effects of sequence of returns risk on your retirement portfolio.

Strategies for managing the Sequence of Return Risk

There are strategies and tactics that investors can use to help reduce sequence of returns risk (SORR) now and in the future. It’s important for investors to understand their options to help create a retirement income plan that considers this potential risk.

Here are some strategies to help you achieve this goal:

- Diversify your portfolio: One way to help minimize financial risks in retirement is by diversifying your portfolio. This means spreading your investments across multiple asset classes, including stocks, bonds, and real estate. This strategy helps spread out risk and so that if one asset class performs poorly, the others may still provide positive returns.

- Consider Guaranteed Income Products: Guaranteed income products, such as annuities and life insurance, can help reduce the risk of outliving your retirement savings. These products can provide a steady stream of income, regardless of market conditions, for the rest of your life.

- Use a Bucket Plan Approach: The Bucket Plan approach involves dividing your asset into three different “buckets” (Now, Soon and Later) based on your risk tolerance and time horizon of when you will need to access the funds. By allocating funds in your retirement portfolio in this manner, you can help reduce the impact of market volatility on your retirement savings.

- Use a Tax-Efficient Withdrawal Strategy: By using a tax-efficient withdrawal strategy during a down market, you may keep more of your savings by pulling a portion (or all) of your income from tax-free accounts so you don’t have to pay taxes on your withdrawals.

- Maintain a Conservative Withdrawal Rate: Try limiting your withdrawals each year by taking a smaller percentage of your savings out as income. This will help reduce the impact of negative market returns and stretch your savings.

By understanding the sequence of returns risk and taking steps to help reduce it, investors can help protect their retirement savings from market volatility so they may have enough money for the future they want.

In conclusion

Knowing the potential risks and challenges of retirement planning is only half the battle.

Being proactive and understanding the importance of creating a financial plan that considers the sequence of returns risk is important to helping maximize your retirement income now and in the future.

Remember that each person’s financial situation and goals are unique, so planning ahead helps build a solid foundation to prepare for your retirement.

It’s important to remember one simple tip: consult an experienced financial planner who can provide knowledgeable advice tailored specifically to your circumstances and needs.

Contact Intelliplan Financial today to help get started on protecting your retirement savings now!

Disclosure: Financial Planning and Advisory Services are offered through Prosperity Capital Advisors (“PCA”), an SEC-registered investment adviser. Registration as an investment adviser does not imply a certain level of skill or training. Intelliplan Financial and PCA are separate, non-affiliated entities. PCA does not provide tax or legal advice. Insurance services offered through Intelliplan Financial are not affiliated with PCA.

Financial Planning and Advisory Services are offered through Prosperity Capital Advisors (“PCA”), an SEC registered investment adviser. Registration as an investment adviser does not imply a certain level of skill or training. Intelliplan Financial and PCA are separate, non-affiliated entities. PCA does not provide tax or legal advice.