Making the transition into retirement can be challenging, and there are a lot of questions to answer. Among them is “Are Social Security Benefits Taxable for Retirees?” The short answer is: it depends.

It’s significant for retirees and those soon to retire to understand how taxes work regarding Social Security benefits as this can impact their overall income and financial situation.

In this blog post, we’ll cover exactly what you need to know so that you can make informed decisions about your retirement income strategy, including whether or not your Social Security benefits may be taxable.

What are Social Security benefits, and how are they taxed?

Social Security is a social insurance program administered by the United States Social Security Administration. It provides guaranteed monthly benefit payments to retirees who have reached the eligible age of 62 or over. The amount of social security benefits one receives depends on how much they paid into social security during their working lives and their age.

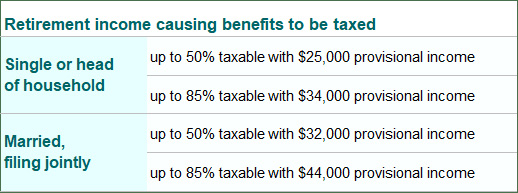

Some people are not aware of the potential of up to 85% of your Social Security may be subject to taxes! That amount depends on your provisional income. Provisional income is your adjusted gross income plus any non-taxable interest plus one and a half of your social security benefit. Depending on what your provisional income is, either 0%, up to 50%, or up to 85% of your benefits received could be subject to federal income tax.

Generally speaking, if your total income is between $25,000 and $34,000 as an individual or between $32,000 and $44,000 as a married couple filing jointly, up to 50% of your social security benefits are taxable at the federal level. Additionally, if your combined income is more than $34,000 as an individual or $44,000 filing a joint return as a married couple, then up to 85% of your social security benefits can be subject to taxation.

Make sure you consult with a financial professional before you start taking retirement income, as there may be significant financial implications based on your calculation of Social Security payments and taxable income.

What happens if my benefits are taxable?

If your social security benefits are taxable, then you’ll need to pay taxes on them.

You should also know that all income sources need to be reported on your federal tax return. So make sure to pay attention and pay any due taxes by the deadline.

How can I reduce the amount of taxes I have to pay on my Social Security benefits?

One way to reduce the federal tax you may owe on your Social Security benefits is to consider minimizing the income you are withdrawing from taxable accounts such as 401(k)s and IRAs. Of course, if you’re forced to take your required minimum distribution (RMD) for the year, you will have no choice but to take the income.

However, if you don’t have to take an RMD, you may want to consider pulling funds from tax-free accounts such as Roth IRAs, Roth 40k(k)s, and certain life insurance policies to help reduce your taxable income.

These are just two ideas that may or may not be beneficial for our situation. Be sure to consult a qualified tax and financial professional for additional strategies tailored to your financial situation.

What should I do if I have questions about my Social Security benefits and taxes?

If you have any questions about social security benefits, your best bet is to contact the Social Security Administration directly. The SSA is able to provide fact-based answers, as well as help with calculating social security taxes and benefits.

Your social security benefit statement can also provide summaries of past earnings, estimates of future retirement and disability benefits, and estimates of the social security and Medicare taxes you have paid. You can access your statement online by creating a mySocialSecurity account with the Social Security Administration.

Additionally, tax advisors and certain financial professionals may offer advice tailored to you, so do research on how they might be able to assist.

Finally, having all the information in one place is advantageous when considering your social security benefits and taxes, so make sure you are taking the initiative to receive the best guidance possible for a comprehensive understanding.

In Conclusion

Navigating the world of retirement taxes can be tricky, but it is important to make sure you are getting all the money you are entitled to receive.

Social Security benefits can be taxable, depending on your income level and filing status. However, it’s important to know because you want to avoid getting caught off guard come tax season.

If you are still determining whether or not your social security benefits are taxable, contact Intelliplan Financial today. Schedule your complimentary consultation here. Our team of financial professionals will help you understand your unique tax situation and what steps you need to take to get the most out of your retirement years.

Disclosure: Financial Planning and Advisory Services are offered through Prosperity Capital Advisors (“PCA”), an SEC registered investment adviser. Registration as an investment adviser does not imply a certain level of skill or training. Intelliplan Financial and PCA are separate, non-affiliated entities. PCA does not provide tax or legal advice. Insurance services offered through Intelliplan Financial are not affiliated with PCA.

Financial Planning and Advisory Services are offered through Prosperity Capital Advisors (“PCA”), an SEC registered investment adviser. Registration as an investment adviser does not imply a certain level of skill or training. Intelliplan Financial and PCA are separate, non-affiliated entities. PCA does not provide tax or legal advice.