Did you know that 67% of retirees today rely on Social Security for at least half of their retirement income, yet nearly 49% of Americans don’t understand how to maximize these benefits? What’s more, the difference between optimal and sub-optimal claiming strategies can exceed $100,000 in lifetime benefits for the average married couple.

Social Security can be a complex topic, but understanding how it works is essential for creating a successful retirement strategy. As part of our commitment to helping you plan smarter and live better, we’ve compiled five of some of the most asked questions and answers we receive about Social Security benefits:

But First—Why Social Security Matters in Your Retirement Plan

Social Security was never meant to be your only source of retirement income. According to the Social Security Administration, these benefits typically replace only about 40% of an average wage earner’s income after retiring. Most financial professionals suggest you’ll need 70-80% of your pre-retirement earnings to live comfortably in retirement.

However, Social Security retirement income offers significant advantages that other income sources don’t provide, including:

- Guaranteed income for life – you’ll never outlive your Social Security benefit

- Cost-of-living adjustments to help keep up with inflation

- Tax advantages compared to some other retirement income sources

Understanding how to maximize these benefits can make a substantial difference in your retirement quality of life.

Question #1: What Does “Full Retirement Age” for Social Security Mean?

Full Retirement Age (FRA) is the age at which you’re eligible to begin collecting your maximum Social Security benefits.

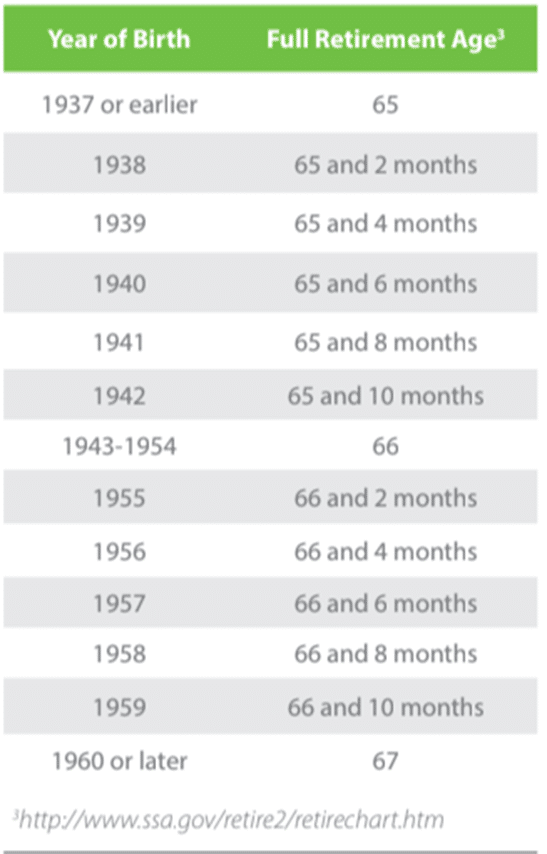

See the Social Security retirement age chart:

For those born between 1943 and 1954, the Full Retirement Age is 66. For those born in 1960 or later, it’s 67. If you were born between 1955 and 1959, your Full Retirement Age increases gradually from 66 years and 2 months to 66 years and 10 months.

This doesn’t mean you must wait until your Full Retirement Age to collect benefits. You can begin accepting a reduced level of benefits as early as age 62 or delay benefits beyond your Full Retirement Age for increased monthly payments.

Question #2: How Much Will I Lose If I Take My Social Security Benefits Early?

Determining when to take Social Security benefits or if delaying Social Security benefits increases lifetime income is usually top of mind for our clients.

If you begin collecting benefits at your Full Retirement Age, you’ll receive nearly 25% more in monthly benefits than if you had chosen to begin collecting at age 62.

If you delay benefits until age 70, your monthly payment will be approximately 60% higher than if you started collecting at age 62. That’s a significant difference that could substantially impact your retirement lifestyle!

Here’s what to consider when deciding:

- If you have limited investments and need immediate income, starting at 62 might make sense

- If you’re in good health and expect to live well into your 80s or beyond, waiting offers a better long-term payout

- If you plan to continue working, be aware of potential benefit reductions due to earned income before reaching Full Retirement Age

Question #3: Am I Required to Pay Taxes on Social Security Benefits?

Many retirees are surprised to learn that their Under current rules, taxation depends on your total income and benefits received during the tax year.

- If you’re single or widowed, you may earn up to $25,000 per year without paying taxes on your Social Security benefits

- If you’re married and file a joint tax return, you’ll be required to pay taxes on your Social Security benefits if your total income exceeds $32,000 per year

This is why tax planning before and during retirement is a crucial part of a holistic financial strategy.

Question #4: Will I Have to Stop Working When I Begin Accepting Monthly Social Security Benefits?

No, you can continue working while receiving Social Security benefits. However, if you haven’t reached your Full Retirement Age and your earnings exceed certain limits, some of your benefits may be temporarily withheld.

For example, if you’re under Full Retirement Age and earn more than the annual limit ($23,400 in 2025), you’ll lose $1 in benefits for every $2 you earn above that limit.

The good news? Once you reach Full Retirement Age, these earnings limits no longer apply, and you can work and earn as much as you want without any reduction to your Social Security benefits.

Question #5: What Happens to My Spouse’s Benefits If I Die First?

This question addresses one of the most important planning aspects of Social Security, especially for couples with significant age differences or earnings disparities, and the reality that women tend to outlive men.

If you die before your spouse, they may be entitled to Social Security survivor benefits based on your earnings record. These benefits typically range from 75% to 100% of your original monthly benefit and last until your spouse dies.

Additionally, there’s a one-time death benefit payment of $255 that can be paid to your surviving spouse.

is crucial for ensuring your spouse will have adequate income after you’re gone. This is particularly important if your Social Security benefit is significantly higher than your spouse’s.

Making the Right Social Security Decisions for You

The choices you make about Social Security can have a lasting impact on your retirement security. While these five questions address some of the most common concerns, there are many more factors to consider based on your unique situation.

If you’re approaching retirement or simply want to make sure you’re on the right track, now is the time to take action. Schedule a complimentary consultation with our team today—we’ll help you evaluate your options, avoid costly mistakes, and build a comprehensive retirement strategy that’s tailored to you. Your Social Security benefits are too important to leave to chance. Let’s get it right—start planning smarter today.

Disclosure: Financial Planning and Advisory Services are offered through Prosperity Capital Advisors (“PCA”), an SEC-registered investment adviser. Registration as an investment adviser does not imply a certain level of skill or training. Intelliplan Financial and PCA are separate, non-affiliated entities. PCA does not provide tax or legal advice.

Financial Planning and Advisory Services are offered through Prosperity Capital Advisors (“PCA”), an SEC registered investment adviser. Registration as an investment adviser does not imply a certain level of skill or training. Intelliplan Financial and PCA are separate, non-affiliated entities. PCA does not provide tax or legal advice.