Rising inflation, complex tax implications, and evolving retirement needs have transformed how we need to think about building and preserving wealth. It’s no longer just about how much you save – it’s about how strategically you can save.

Many of our clients come to us having successfully accumulated wealth through their careers, yet they’re seeking smarter ways to protect and optimize what they’ve built.

Think about your current saving strategy and if you should consider a more tax-efficient approach – especially if you’re approaching retirement.

Why Traditional Saving Strategies May Not Be Enough

Many of our pre-retiree clients find themselves caught in a familiar pattern: maximizing their 401(k) contributions, maintaining a standard savings account, and hoping it will be enough for retirement.

However, successful retirement income distribution planning today requires more than just accumulating assets – it needs a strategic approach to both saving and withdrawing your money effectively.

Today’s savers face unique challenges:

- Inflation erodes the purchasing power of traditional savings

- Higher living costs can impact your monthly saving capacity

- Complex tax implications may affect retirement account withdrawals

Traditional saving approaches served previous generations well, but today’s financial landscape offers new opportunities for those who want to make their savings work more efficiently.

1. Incorporate Tax Management

One of the most overlooked aspects of saving is tax efficiency. Every dollar saved in taxes is another dollar that can work toward your retirement goals.

If you’re wondering how you can be more tax-efficient in your saving strategy, consider tax management — a year-round approach to preserving your wealth by minimizing your taxes. Think of it as organizing your savings across three different tax environments: tax-now, tax-later, and tax-never. Each plays a vital role in your overall financial strategy.

Here are a few ways to implement tax-efficient saving strategies:

Retirement Account Optimization

Traditional retirement accounts like 401(k)s and IRAs offer tax-deferred growth, but they create future tax obligations. Strategically balancing these with tax-free accounts like Roth IRAs, can create more tax flexibility in retirement. For example, during lower-income years, converting portions of traditional IRAs to Roth accounts can help build your tax-free retirement income streams.

Understanding the maximum Social Security benefits in 2025 can also help you plan your withdrawals more efficiently. When you know these benefit limits, you can time your retirement account withdrawals more strategically, helping protect your retirement income from unnecessary taxes. This coordination between Social Security income and retirement account withdrawals can help preserve more of your wealth by minimizing your overall tax burden during retirement.

Health Savings Accounts (HSAs)

HSAs offer what we call “triple tax advantages” – a unique combination that makes them powerful savings tools:

- Your contributions are tax-deductible

- The money grows tax-free inside the account

- Withdrawals for qualified medical expenses come out tax-free. This makes HSAs an excellent complement to your retirement savings strategy, especially for future healthcare expenses.

Profit-Sharing Plans

For business owners, qualified profit-sharing plans offer opportunities to optimize business profits for retirement while potentially reducing current tax obligations. These can be structured to work alongside other retirement savings vehicles for maximum tax efficiency.

Charitable Giving Integration

Strategic charitable giving can serve both your philanthropic goals and tax management needs. Tools like qualified charitable distributions (QCDs) from IRAs can satisfy Required Minimum Distributions while reducing taxable income. Donor-advised funds offer another way to manage tax deductions while supporting causes you care about.

2. Integrate Protection with Growth

One of the most powerful approaches to tax-efficient saving comes from understanding how to integrate both protection and growth into a single, coordinated strategy. While many people view insurance and investments as separate tools, combining them strategically can create unique advantages for your financial future.

Consider how a well-structured life insurance strategy can do more than just provide a death benefit. For example, utilizing the Bank On Yourself® strategy creates a financial foundation that serves multiple purposes throughout your life. Permanent life insurance policies can be structured to build cash value over time, growing tax-deferred within the policy similar to a retirement account, but with additional flexibility.

This integration offers several key benefits that support your overall financial strategy:

Access and Control

The cash value you build becomes a resource you can access through policy loans without triggering taxable events, allowing you to fund major purchases or create tax-advantaged supplemental retirement income without disrupting your other investments.

Multi-Layered Protection

Beyond the primary death benefit, these strategies can provide living benefits for chronic illness or long-term care needs, protection against market volatility, and tax-free benefits for your beneficiaries.

Strategic Growth

The growth component works differently than traditional investments, offering predictable cash value growth independent of market performance, with additional dividend potential (though not guaranteed) and uninterrupted compound growth even when accessing funds.

When coordinated with The Bucket Plan®, this strategy can serve multiple time horizons simultaneously, providing both immediate access and long-term tax advantages while protecting your other assets for their intended purposes.

3. Plan for Multiple Time Horizons

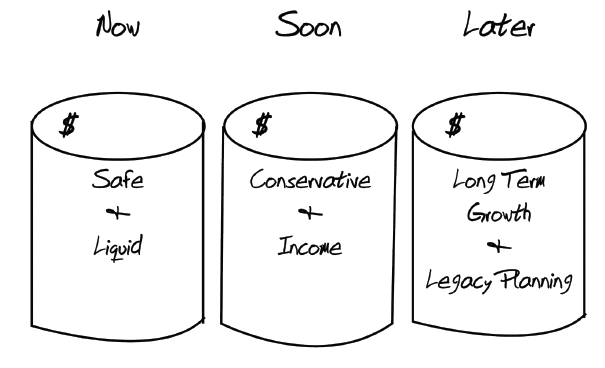

When we talk about tax-efficient saving strategies, The Bucket Plan® stands out as a powerful approach that goes beyond basic time-based organization. By strategically positioning your assets across different tax environments based on when you’ll need them, we can help optimize the tax treatment of each dollar in your plan.

This time-based segmentation isn’t just about access – it’s about creating tax efficiency throughout your retirement journey

For example, your Now bucket might utilize tax-paid money market accounts for immediate needs, while your Later bucket can take advantage of tax-advantaged growth vehicles like Roth accounts or specially designed life insurance contracts.

When structured properly, this approach helps minimize your tax burden while ensuring you have the right money available at the right time.

Bonus Tip: Consider Combining Strategies

By layering these strategies together, you can create a comprehensive approach that helps protect your wealth while maintaining access and growth potential based on when you’ll need the funds.

For instance, if you’re a business owner you might combine a Bank on Yourself® policy for flexible access to capital, a profit-sharing plan for tax-efficient business savings, and a strategic investment portfolio distributed across The Bucket Plan® – all working in harmony to support different financial needs and time horizons.

Take Action

As you reflect on your saving strategy, consider these steps:

- Review your current saving approach to identify any tax inefficiencies

- Assess whether your savings are properly positioned for different time horizons

- Evaluate if your protection strategy aligns with your wealth preservation goals

Need help with any of these steps? Schedule a complimentary consultation with our team at Intelliplan Financial. We’ll help you develop a personalized plan that integrates tax-efficient saving strategies with The Bucket Plan® approach, helping ensure your hard-earned wealth works as intelligently as possible for your future

Bank On Yourself® is a registered trademark used with permission.

Disclosure: Financial Planning and Advisory Services are offered through Prosperity Capital Advisors (“PCA”), an SEC-registered investment adviser. Registration as an investment adviser does not imply a certain level of skill or training. Intelliplan Financial and PCA are separate, non-affiliated entities. PCA does not provide tax or legal advice. Insurance services offered through Intelliplan Financial are not affiliated with PCA.

Financial Planning and Advisory Services are offered through Prosperity Capital Advisors (“PCA”), an SEC registered investment adviser. Registration as an investment adviser does not imply a certain level of skill or training. Intelliplan Financial and PCA are separate, non-affiliated entities. PCA does not provide tax or legal advice.