Are you looking for a way to gain better control of your finances, save money and increase wealth?

If so, consider becoming your own banker by using life insurance as a key financial tool.

Life insurance can be a powerful tool. Investors have used it over many years for investing and utilizing their policies as their own banks. Ever hear of Walt Disney or J.C. Penney? These are just two of the many famous people who have utilized their life insurance policies to self-finance their businesses.¹

While some people choose to use term life insurance for the death benefit, we will specifically discuss why dividend-paying whole life insurance (permanent life insurance) makes an effective banking tool and how it works in this blog post.

With this post, we hope to provide some information on how life insurance could be an important part of an investor’s portfolio now and in the future.

How do life insurance policy loans work?

One “living benefit” of a dividend-paying whole life insurance policy is that you build up cash value which you can access at any time through policy loans. Policy loans are a great way to access cash flow for emergencies, major purchases like real estate, funding college and retirement, and more.

When you take a policy loan you are borrowing against your cash value and using the policy’s death benefit as collateral for the loans. You have the option to borrow up to 85-90% of your cash value at any time and since you are not dealing with traditional banks or traditional lenders, the only questions you will be asked are, “How much would you like, and where would you like the money sent to?”.

When you purchase a policy through a life insurance company that offers “non-direct recognition” loans – which is important when it comes to utilizing this banking concept – your policy will continue to receive growth and dividends as if you never took the money out. This is because the money you borrow doesn’t come directly from your personal life insurance policy. Instead, it comes from a general fund set aside by the life insurance company of all policies pooled together.

What about loan repayments? There are no requirements when it comes to paying back your policy loans. If you don’t repay your loans, they will be deducted from the death benefit (along with any interest due) before the company pays out the death benefit upon your passing.

Loan repayments are straightforward and you have a few options on how you may repay your loan. Monthly payment plans can be set up to automatically come out of your bank account each month, or you can make lump-sum repayments throughout the year(s) to pay down your loan balance.

It’s important to note that when you take out a policy loan, the insurance company will typically charge interest on the amount borrowed. Interest rates are typically at below-market value and it is not required to pay this interest. If you don’t pay the loan interest, which is calculated at the end of each policy year, the company will automatically add the interest to your loan balance. Any unpaid loan interest at the time of your passing will be deducted from the death benefit payout to your beneficiary(ies).

Though it is not required to pay back your policy loan or loan interest, our general recommendation is to pay back both to prevent your loan and interest balance from growing to an amount greater than your death benefit. If that happens, your policy will lapse which would cause you to lose coverage, and possibly trigger a taxable event.

Advantages of becoming your own banker using Life Insurance

Life insurance policy loans can provide a unique source of financing that offers several potential advantages over other types of loans. By borrowing against the cash value of a life insurance policy, policyholders have access to several benefits we discuss below.

Reduces lost opportunity cost

Did you know you finance everything you buy? It’s true!

This is because you will either need to pay interest to finance or lease the purchase, or you will miss out on the potential interest and investment income you could have earned if you had kept your money invested instead. This is called your opportunity cost.

Opportunity cost is the value you could have gained by selecting a different course of action – or in our case the potential income that’s foregone as a result of choosing one option over another.

To further help explain this, let’s walk through three different financing scenarios called The Debtor, The Savor, and The Wealth-Creator:

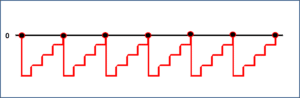

- The Debtor – Debtors will finance their lifestyle by putting purchases on credit cards or taking other types of loans, paying them off, then repeating the process. Cash is constantly leaving, making it difficult to build up savings. In this instance, banks and credit card companies are the ones who benefit from this strategy – not you!

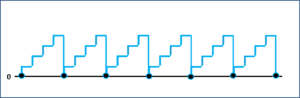

- The Saver – Savers do the opposite of Debtors. They will save their money in their bank accounts to pay for purchases using cash to avoid paying interest to credit card companies and banks. However, Savers must realize what they are doing. Though they are saving money, they eventually spend the money, which depletes their account balance, then have to save more money to make up for the loss of money when making purchases. They end up right back where they started, which is why Savers can never get ahead. Though they eliminate having to pay interest, they also eliminate the opportunity to earn.

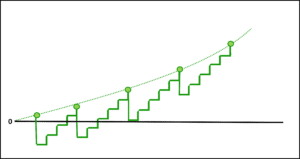

- The Wealth-Creator – Wealth-creators utilize the properly-structured dividend-paying whole life insurance to create their own “private” bank. Doing so, they build up a pool of money within their policy, access that money whenever they want, then pay the money back to the policy; all the while, the policy continues to potentially grow uninterrupted as if the money was never taken out. By using this method, you reduce your lost opportunity cost as your money works double-duty for you and potentially allows you to earn growth on money that you’ve spent.

Flexibility and Control

A dividend-paying whole life insurance policy loan potentially offers more flexibility and control of your money. By borrowing from your policy’s cash value, you can access your money at any time when you need it without going through a bank or lender. This can be especially useful for individuals needing help obtaining loans due to a poor credit score or other factors that would typically make them ineligible for traditional loans.

Dividend-paying whole life policy loans potentially offer more flexibility and control since:

- There are no repayment terms on a policy loan. (Beware of your policy lapsing)*

- You can choose how much and when you want to start paying back your policy.

- No need to even set up a repayment plan. Send in a check for whatever amount at any time.*

Note: Withdrawals taken for retirement income are an exception and have different terms. For further information, schedule a complimentary call with one of our qualified financial professionals who is trained and knowledgeable about this type of policy.

Easy to request

Since you are not dealing with traditional banks or lenders, accessing money from your life insurance policy is easy because there are:

- No questions.

- No credit application is required.

- No effect on your credit profile or credit score.

The insurance company will cut you a check or wire the funds into your bank account, and in a few days—typically around a week—you will have your money.

You can take policy loans for about anything

Since you are borrowing against the cash value of your life insurance policy, rather than a traditional loan from a bank, you can take a policy loan out for just about anything.

You can take a policy loan to financing major purchases such as:

- cars

- vacations

- college education

- business expenses

- covering living expenses after losing a job or other financial hardship

- funding retirement

- or real estate

The possibilities are almost as endless as your imagination.

Policy loans are tax-free

Another advantage of using dividend-paying whole life insurance as a source of financing is the tax advantages it can provide.

The cash value and dividends of your life insurance policy generally grow tax-free within the policy. Additionally, the proceeds of policy loans are not typically considered taxable income. Similar to how you don’t pay income tax on a loan taken out to purchase a car, the loans taken out from your life insurance policy are also not typically subject to taxes.*

In conclusion

In conclusion, becoming your own banker by using life insurance is one way to help secure your financial future. Using a life insurance policy to fund major purchases over your lifetime can help you get ahead financially in the long-term.

Dividend-paying whole life insurance policy loans are user-friendly, offering flexibility and easy request processing. With just a few steps, you can start taking control of your finances without compromising liquidity or security. Plus, you’ll have cash on hand for every life event or venture that comes your way.

Don’t wait any longer—contact Intelliplan Financial today to get started on becoming your own banker and kickstarting a more secure financial future for yourself and your family!

* Though it is not required to pay back your policy loan or loan interest, our general recommendation is to pay back both to prevent your loan and interest balance from growing to an amount greater than your death benefit. If that happens, your policy will lapse which would cause you to lose coverage, and possibly trigger a taxable event.

Source:

Disclosure: Financial Planning and Advisory Services are offered through Prosperity Capital Advisors (“PCA”), an SEC-registered investment adviser. Registration as an investment adviser does not imply a certain level of skill or training. Intelliplan Financial and PCA are separate, non-affiliated entities. PCA does not provide tax or legal advice. Insurance services offered through Intelliplan Financial are not affiliated with PCA.

Financial Planning and Advisory Services are offered through Prosperity Capital Advisors (“PCA”), an SEC registered investment adviser. Registration as an investment adviser does not imply a certain level of skill or training. Intelliplan Financial and PCA are separate, non-affiliated entities. PCA does not provide tax or legal advice.