A plan for peace of mind in retirement

Retirement should be an exciting time in your life, not filled with financial anxieties about whether you’re making the right choice to save, withdraw, invest here or there, and more.

If you’re wondering how to make the most of your savings for a comfortable retirement, we can help — with a proven financial planning process and philosophy called The Bucket Plan®.

We’re dedicated to empowering our clients through education and sound financial decisions, and we use The Bucket Plan® philosophy to do both as part of our holistic planning process. With the Bucket Plan®, we strategically allocate your assets, mitigating the modern risks of today and helping you get the most out of your wealth in retirement.

See the short video below to learn more about how we use The Bucket Plan® to prepare and protect against risks and how it can can help provide more peace of mind over traditional planning methods.

Designing Your Bucket Plan®

Now, Soon, and Later Financial Planning

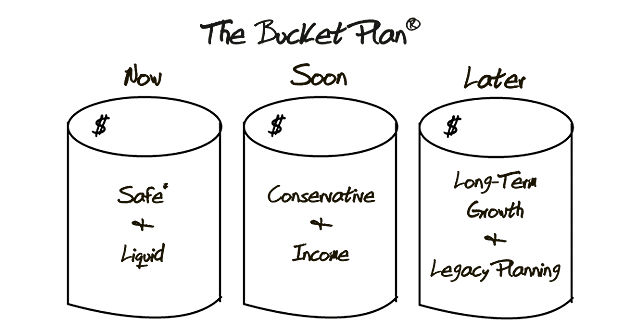

The Bucket Plan® offers a smarter way to manage retirement funds over traditional investing methods by dividing them into three buckets: now, soon, and later.

As we’ll explain in greater detail when meeting with you and maybe using a drawing or two, the “now” bucket contains funds for immediate expenses, like a car or vacation. The “soon” bucket is for the money that we can also invest conservatively and for what you’ll need as the years go on and daily living

expenses get more expensive through inflation. Lastly, the “later” bucket is for long-term growth, invested with the future in mind, focusing on higher returns for retirement and beyond.

By considering factors like time until retirement, risk tolerance, and income needs, we provide a comprehensive financial plan that strategically addresses your financial needs over time.

Key Benefits of The Bucket Plan®

Think of it like this — when we create your personalized Bucket Plan®, you’re getting a clear path to a worry-free retirement through:

- Reduced market risks through strategic asset allocation.

- Continuous income flow during retirement, ensuring your lifestyle is maintained without the fear of running out of money.

- Adaptability to life changes with a plan that can evolve as your situation does.

- Clear segmentation of assets for now, soon, and later needs, making it easier to manage and access your funds.

At the end of the day, this strategy doesn’t just preserve and protect your wealth, it provides you with a clear understanding and systematic control over your retirement plans.

Still not sure how this approach can help provide financial security in retirement? Grab a free copy of our Benefits of a Bucket Plan® Strategy Guide below!

Trust our Bucket Plan® Certified Advisor

What’s best for our clients is best for us, which is why we take the time and complete the training to become Bucket Plan Certified® advisors. You can rest assured that we possess the skills to properly use the Bucket Plan® framework to optimize your savings and create a plan to meet your various needs effectively and efficiently throughout retirement.

Bucket-Based Wealth Preservation

Running out of money in retirement or not being able to achieve all you hoped for is a common concern and one we understand. Luckily, The Bucket Plan® helps tackle that fear by guiding you through the process of effectively accumulating, preserving, and distributing money in retirement. Watch the short video below to learn how this adaptive financial planning method helps reduce your risk of depleting your savings too quickly in retirement.

The Bucket Plan® Book

Protecting and Growing Your Assets for a Worry-Free Retirement

The strategy and philosophy of the Bucket Plan was so well received by advisors and their clients, that it became a best-selling book and audiobook, The Bucket Plan: Protecting and Growing Your Assets for a Worry-Free Retirement.

While we use the best planning process as advisors to form a comprehensive retirement plan for you, the book which is written directly to consumers, is an easy-to-understand and powerful resource to enhance your understanding of this innovative approach.